Governance and Risk Management

Governance and Board Oversight at GAIL

GAIL, as a responsible Public Sector Undertaking, sets the standard for ethical business conduct by prioritizing the development and implementation of a solid corporate governance structure. GAIL’s corporate governance framework is intended to detect, analyse and handle the risks, as well as provide constructive feedback, to align management’s responsibilities with the Board’s oversight of the company. We examine and update our policies and processes on a regular basis to manage risk exposures, which are critical to our company’s smooth functioning.

Governance Structure

The Board of Directors and various Board committees, remains at the top of the governance system. GAIL has a unifi ed Board structure that is controlled by a formal Board Charter that outlines the Board’s composition, responsibilities and member selection procedure.

As of 31st March 2022, the Board consists of 12 members, including 05 functional directors (including the Chairman and Managing Director) and 07 non-executive directors (comprising 01 Government Nominee Directors and 06 Independent Directors). Our Board also includes 01 woman Director. The typical tenure of a Board member is three to four years. Our Board of Director’s diversity policy mentions that the Board should include an optimal mix of executive and non-executive directors, with at least one woman Independent Director on the Board. The Government of India nominates and appoints the directors.

Our executives have extensive experience in the fi elds of marketing, project, operators, fi nance and governance and they place a high emphasis on sustainability and ESG. We additionally hold frequent capacity-building sessions on the changing ESG landscape including climate change, which are detailed in the subsequent chapters of this report. Additional information about the Board’s composition and member profi les can be found on our website. https://www. gailonline.com/ABLeadership.html

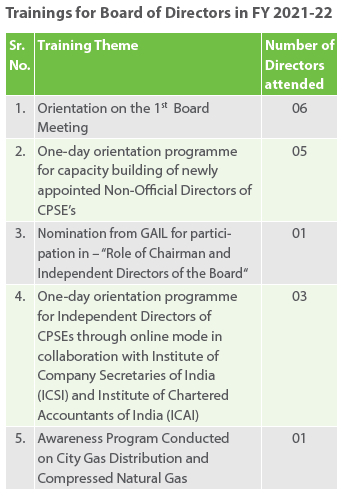

The Board of Directors oversee the organizational management and ensure that all the stakeholder needs are met promptly. The Board of Directors and senior management team endeavour to recognize the long-term interests of multiple parties by responsibly resolving the concerns of stakeholders in our value chain. The deliberately designed induction and orientation workshops help newly appointed Directors grasp the organizational structure and contribute to the overall growth of the firm. During the induction period, they are given a welcome kit that detail their tasks and responsibilities, as well as any legal or regulatory policies they are required to follow. We provide adequate training to the Board members to enhance and upgrade their skill and expertise, as per our training policy. As part of this policy, Board members, including the Directors, are frequently nominated to speak at industry conferences hosted by organizations like the Department of Public Enterprise (DPE), the Standing Conference of Public Enterprises (SCOPE) and other global organizations such as the World Economic Forum (WEF), the International Energy Agency (IEA), the International Gas Union (IGU) and Bloomberg.

Committees of the Board

As on 31st March 2022, GAIL’s governance structure consists of 13 committees of the Board of Directors including five statutory committees mainly, Audit Committee, Corporate Social Responsibility Committee, Nomination and Remuneration Committee, Stakeholders Relationship Committee and Risk Management Committee. The well-defined Terms-of-Reference enable each committee to work efficiently, including the prompt resolution of concerns, since each committee performs specialized responsibilities. The following table enumerates the various committees at the Board level:

The inclusion of both independent and nonindependent directors in each committee not only offers diversity to the Board, but also allows it to be fair and just in its proceedings. While the Board works on its pre-determined strategic focus areas, it is devoted to setting performance targets that includes ESG specific and climate change related goals for the entire year. The Board of Directors evaluates and monitors the committees’ performance, as well as the company’s targets and goals on a regular basis.

Our Annual Report for FY 2021-22 contains detailed information on composition of our statutory Board committees and GAIL’s corporate governance policies. The same can be accessed on our website too https://www.gailonline.com/ pdf/CSR/CGRAsOn31032022.pdf.

Performance Evaluation, Remuneration and Incentives

We are a Public Sector Enterprise and our Directors are appointed/nominated by the Government of India, which also carries out the performance evaluation as an appointing authority. The role of Nomination and Remuneration Committee is as per SEBI (LODR) Regulations, 2015, the Companies Act, 2013 and Department of Public Enterprises (DPE) guidelines on Corporate Governance for Central Public Sector Enterprises, 2010 as amended from time to time. As on 31st March 2022, the Nomination and Remuneration Committee of the company comprised of Dr. Nandhagopal Narayanasamy as the Chairperson, Dr. Navneet Mohan Kothari and Shri Sher Singh as the member(s). Prior to consideration by the Board, the Nomination and Remuneration Committee is responsible for reviewing issues relating to compensation and incentives other than Performance Related Payment (PRP). Performance of the company and board members are evaluated on both financial and non-financial criteria, as specified in the MoU between GAIL and the Ministry of Petroleum and Natural Gas (MoPNG). The MoU provides the vision, weightage and targets which are related to economic parameters like revenue, Market Cap, Capex, EBITA etc as well as expenditure on R&D/innovation initiatives, procurement from MSMEs (marginalised groups and women), compliance with Company’s Act etc. The senior management performance evaluation, which includes the CMD, Directors, EDs and GMs, is based on the individual’s parametric scoring based on the GAIL’s business, financial, CSR, human resource and R&D performance during the reporting period. This comprises both financial and nonfinancial goals aimed at improving the company’s overall ESG performance. The Annual Report and the MOU signed with the government contain more information on the performance target and its equivalent compensation. The performancerelated remuneration is calculated using the performance evaluation score and the composite score. Despite the continuing adverse effects of the COVID-19 pandemic in the current reporting year, GAIL has made sincere attempts to fulfil its MoU responsibilities. Self-evaluation of the MoU for FY 2021-22 will be completed and submitted to the Department of Public Enterprises (DPE) on time.

During FY 2021-22, our female employees in the management and non-management positions received an average monthly remuneration of INR 1,31,652 and INR 62,168 respectively, while their male counterparts in executive and management positions earned INR 1,49,724 and INR 67,540, respectively. The management and non-management levels have ratios of 0.87 and 0.92 (average female salary to average male salary). During the reporting year, GAIL did not encounter any delays in paying its employees’ compensation. Payments are executed according to the pay cycle that has been established.

The annual total remuneration for the highestpaid individual decreased by 35.44% from FY 2020-21 to FY 2021-22. The annual total compensation for all employees (excluding the highest-paid individual) increased by 6.23% on average from FY 2020-21 to FY 2021-22. The ratio of the organization’s highest-paid individual’s annual total compensation to the median annual total compensation for all employees (excluding the highest-paid individual) is 2.58.

Highlights of Remuneration and Incentives at GAIL

- In FY 2021-22, the total compensation of the CEO/CMD was INR 97,10,831.

- In FY 2021-22, the median compensation of all employees (except CEO/CMD) was INR 14,06,628.

- In FY 2021-22, the mean compensation of all employees (except CEO/CMD) was INR 15,65,645.

- The ratio between the CEO/CMD annual compensation and the median of all employees’ compensation is 2.58.

- The ratio between the CEO/CMD annual compensation and the mean of all employees’ compensation is 6.2.

Avoidance of Conflict of Interest

By establishing the right leadership, we aim to foster a culture of ethics and trust. To ensure that there are no conflicts of interest in workforce operations, we promote transparency and responsibility among all our stakeholders. Furthermore, we are fostering a trustworthy workplace in which employees are not hesitant to raise and expose potential conflicts of interest. A Board-level deliberation is also conducted to adequately manage such difficulties and concerns. In this sense, GAIL’s conflict of interest policies are as follows:

- Whenever any director has a direct or indirect stake in an agenda/matter, they would refrain from participating in the discussion. Each director gives the disclosure of his interest in any company or body’s corporate firm, or other association of individuals by giving a notice in writing; and the same is put up to the Board.

- GAIL’s Related Party Transaction Policy enables us to address any related party transactionrelated challenges and concerns. The SEBI (Listing Obligations and Disclosure Requirements) (Fourth Amendment) Regulations, 2019 (Amended from time to time) and the Companies Act, 2013, govern the parameters for this policy. It also includes materiality policies and recommendations for handling transactions involving related parties. Our Annual Report is the vehicle through which we disclose our concerns with conflicts of interest.

Our Annual Report contains further information on each Director’s attendance, number of additional Directorships, Chairmanship/ Membership of Committees and stock ownership.

Internal Control System and their Adequacy

To increase operational and financial integrity, we have established promising principles, frameworks and policies as part of our internal control system. Improved financial reporting process contribute to the development of more accurate and dependable financial statements as well as more comprehensive audits. GAIL’s Internal Financial Control System (IFC) helps the organization generate updated formal, centralized and controlled internal financial control documentation. Following the IFC compliance study, a Risk Control Matrix (RCM) was created in consultation with external consultants.

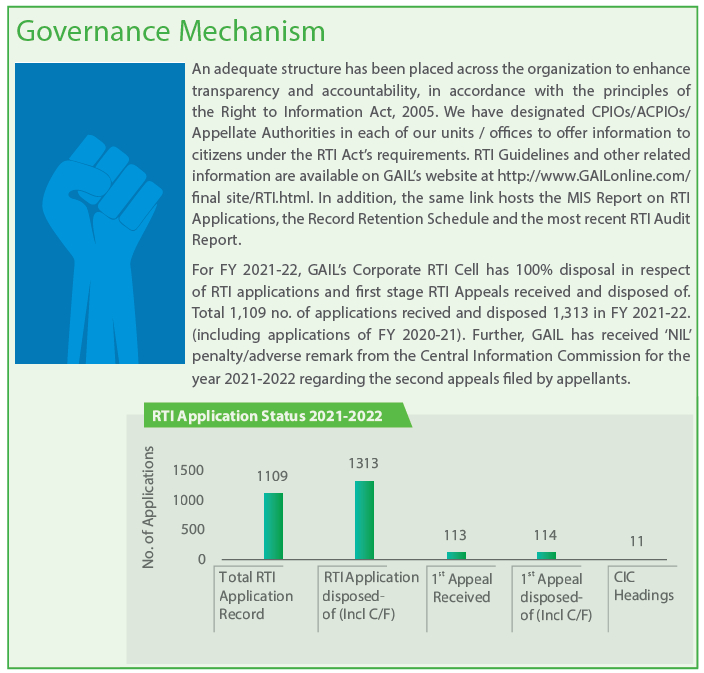

GAIL has received NIL comments from Comptroller and Auditor General (CAG) for 13th year in a row in FY 2021-22.

Audit Committees play a critical role in overseeing internal control. Our internal audit team provides guidance and recommendations on potential gaps and risks, as well as potential efficiencies and process improvements. Members of the audit team have academic and professional backgrounds in accounting, information technology and engineering. This group evaluates the risk management system and informs the audit committee. The Board’s audit committee is responsible for authorising the annual audit and reviewing findings of the audit team as well as the CAG audit. The internal audit team also audits subsidiaries, joint ventures and E&P blocks for the promoters.

Ethics and Integrity

GAIL’s Code of Conduct is intended to support our commitment to conducting business with the highest ethical standards possible. Our corporate processes and practices are geared toward achieving excellence while addressing issues such as the environment, health and safety and human rights, among others.

Our beliefs, principles and standards are outlined in GAIL’s Code of Conduct and accompanying circulars, which serve as the foundation for our operations. We cultivate and enable long-term growth, as well as trustworthy connections with our clients, staff and business partners. This Code of Conduct is required to be followed by all employees, including senior management and Board members, contractors and all corporate representatives. As a responsible company, we follow anti-corruption, anti-boycott, export control and trade sanctions legislation across all our locations. In FY 2021-22, 215 employees (4.52% of total employees) underwent training on anti-corruption and other organizational practices. Our strong policy frameworks allow us to build our business in a sustainable way while also protecting us from corruption and other unethical conduct.

The policies that govern ethics and integrity in our organization are listed below.

- Code of Conduct, Discipline and Appeal (CDA) Rules/Standing Orders

- Fraud Prevention Policy

- Whistle Blower Policy

- Code of Fair Disclosure and Conduct

- Practices and Procedures for disclosure of unpublished price sensitive information.

- Code of Conduct to Regulate, Monitor and Report Trading by Insiders

- Code of Conduct for Board Members and Senior Management Personnel

We have also included a policy for determining materiality disclosure to ensure that our material concerns are communicated to our stakeholders on time. This policy follows Regulation 30 of SEBI LODR, 2015.

We undertake awareness workshops on a regular basis to ensure that our staff and suppliers are committed to fighting corruption and ensuring that we are entirely independent of it. In addition, we conduct periodic risk assessments to identify potential corruption issues in our operational units. During FY 2021-22, we had one corruptionrelated instance and no other major risk of corruption was discovered and reported.

Employees are encouraged to report any suspicious, unlawful, unethical, or improper acts in the business under the Right to Information, Whistle Blower Policy, Fraud Prevention Policy and Integrity Pact. It aids in the organization’s anti-corruption eff orts and strengthens the vigilance system.

GAIL Core Values:

Integrity and Ethics: We are transparent, fair and consistent in dealing with all people. We insist on honesty, integrity and trustworthiness in all our activities and seek to exhibit highest levels of personal and institutional integrity.

Respect: We believe in people. We recognize our responsibility towards the employees and respect their unique contribution, teamwork, dignity, rights and privacy.

Customer: We strive relentlessly to exceed the expectations of our customers and to be their first preference by delivering superior products and services and creating sustainable value.

Safety: We aim to provide a safe workplace for our workforce and the communities around us, respecting the environment.

Excellence: We seek to achieve the pinnacles of excellence in all the business verticals where we have signifi cant presence with continuous improvement and learning.

Technology & Innovation: We acknowledge entrepreneurial spirit and constantly support development of newer technologies, introduction of new ideas/products, improved processes, improved services and management practices.

Transparency in Business

We hold regular meetings and communicate with our stakeholders, shareholders, policymakers and peer companies to take the steps necessary to improve our advocacy approach. This aids us in enhancing and strengthening our anticorruption practices, as well as other parts of our sustainability projects. The Board of Directors examine internal policies pertaining to training, implementation and monitoring actions on a regular basis. We publicly state clear positions, voice our concerns and keep ourselves up to date on industry best practices to adapt and enhance our projects through dialogues and forums.

Tax Strategy

GAIL is a public sector undertaking. The Government of India (GoI) holds 51.45% of the paid-up equity share capital. Policy related to tax strategies are governed by the GoI. We follow statutory requirements including provident fund, employees’ state insurance, income-tax, salestax, service tax, duty of customs, duty of excise, value added tax, cess, Goods and Service Tax and any other statutory dues with the appropriate authorities. We strictly adhere to amendments to tax policies notified by the GOI.

Settlement of Direct Tax Cases – GAIL has applied for settlement of direct tax dispute of FY 2020-21, under the ‘Vivad se Vishwas’ scheme which was accepted by the Income Tax Department. This will result in the settlement of 44 direct tax cases.

Anti-competitive Behaviour

All our stakeholders’ actions combine to help us encourage and maintain clarity in our business operations. We ensure that anticompetitive behaviour is discouraged to strengthen our business. At all levels of our organization, we do this by aligning our systems and procedures with the national and international norms. In the last five years, we have paid no fine or settlements for such wrongdoings.

Cases that were brought to the notice of the dispute resolution processes are still pending.

In addition, status updates on anticompetitive activity, antitrust violations, monopoly legislation and unfair trade practices, in which we have been identified as a participant, were also filed. The status of causes related to anti-competitive behaviour, irresponsible advertising, unfair trade practices and violations of anti-trust and monopoly legislation; in which we have been identified as a participant, is submitted.

We have submitted the status of the following cases up to FY 2021-22, which were settled/ pending regarding unfair trade practices, anticompetitive behaviours, monopolization as identified against GAIL:

- GSPCL filed a case against GAIL before PNGRB claiming Restrictive Trade Practice (RTP) for not allowing to change connectivity from GAIL-PLL to GSPL-PLL connectivity. PNGRB made rulings against GAIL. GAIL challenged the same before APTEL which decided in favor of GAIL. GSPCL appealed against that order before Supreme Court which is pending.

- GSPC Gas filed a case against GAIL claiming RTP before PNGRB but the same was held in favor of GAIL. GSPC Gas has filed appeal against the said order before APTEL and the order of PNGRB has been reversed. Now GAIL has pressed appeal before Supreme Court, which is pending.

- GSPCL filed a complaint against GAIL before PNGRB alleging restrictive practice while booking of pipeline capacity on Renewable Energy Basis. PNGRB while disposing of the complaint filed by GSPCL for booking of capacity on RE Basis held that practice adopted by GAIL while booking common carrier capacity is discriminatory and amounts to restrictive trade practice in as much as it offers bundled services to its customers without requiring them to execute standard GTA on Ship or Pay basis and puts such restriction on other gas suppliers. PNGRB directed GAIL to cease RTP and has also imposed civil penalty of INR 1 lakh on GAIL. GAIL challenged the said order before APTEL. APTEL vide order dated 28th November 2014 dismissed the appeal of GAIL. GAIL then preferred an appeal before Supreme Court. Supreme Court vide order dated 31st January 2016 set aside the order of PNGRB and remanded back to PNGRB for fresh determination considering the affiliate code of conduct. However, the PNGRB once again held RTP against GAIL. GAIL challenged the said order before APTEL wherein vide order dated 28th February 2019, matter referred back to PNGRB for redetermination as per PNGRB Act. However, GSPCL filed appeal in Supreme Court against APTEL order wherein notice has been issued and Status quo to be maintained. Matter is pending.

- M/s. Pioneer Gas Power Ltd has filed a complaint alleging RTP against GAIL for charging Ship or Pay charges under the GTA. The said complaint is pending before PNGRB.

- GIPCL- GIPCL had filed complaint against GAIL before CCI alleging abuse of dominant position in the market. However, CCI declined the complaint. But GIPCL appealed against that order before COMPAT which directed investigation by DGI against GAIL for such abuse. GAIL has filed appeal against the said order before Supreme Court wherein the direction for investigation has been stayed and is pending before Supreme Court.

- Appeal No 131, 132, & 133 of 2016, Sravanthi Energy Pvt. Ltd, Beta Infratech Pvt. Ltd, Gamma Infraprop Pvt. Ltd., had filed complaint before PNGRB alleging RTP against GAIL which was decided against GAIL by PNGRB vide order dated 11th April 2016. GAIL challenged the order of PNGRB before APTEL. APTEL vide its judgement dated 27th October 2021, reversed the finding of PNGRB and dismissed the appeal. SLP has been filed against the APTEL Judgment in Hon’ble Supreme Court of India by Sravanthi Energy Pvt. Ltd, & Gamma Infraprop Pvt. Ltd. which is pending.

Disposal during FY 2021-22:

- Rathi Special Steel, Rathi Bars and Rathi Dakshin Steel and Ors. had filed complaints before CCI alleging anti trade practices under Competition Act. However, same was rejected vide order dated 08.11.2018. Aggrieved by CCI judgment, Rathi Special Steel, Rathi Bars and Rathi Dakshin Steel and Ors. appealed before NCLAT. Vide order dated 24.06.2021, NCLAT dismissed, all three appeals, as withdrawn since parties entered into an out of court settlement.

- Appeal No 131, 132, & 133 of 2016, Sravanthi Energy Pvt. Ltd, Beta Infratech Pvt. Ltd, Gamma Infraprop Pvt Ltd., had filed complaint before PNGRB alleging RTP against GAIL which was decided against GAIL by PNGRB vide order dated 11.04.2016. GAIL challenged the order of PNGRB before APTEL. APTEL vide its judgement dated 27.10.2021, reversed the finding of PNGRB and dismissed the appeal. SLP has been filed against the APTEL Judgment in Hon’ble Supreme Court of India by Sravanthi Energy Pvt. Ltd, & Gamma Infraprop Pvt Ltd. which is pending.

Dispute Resolution Mechanism:-

- Cases brought about through Conciliation during FY 2021-2022 :-

- Gold Plus Glass Industries Vs. GAIL – Conciliation failed since proposal for settlement not approved by Settlement Grievance Redressal Committee (SGRC) of GAIL.

- Present status of cases brought through Conciliation in FY 2019-2020 is as under:

- Newton Engineering Vs. GAIL, Proposal for settlement is pending before SGRC

- GAIL Vs. Bhilosa, Proposal for settlement recommended by SGRC. Approval of Board of Directors (BoD) being obtained.

Stakeholder Grievance Redressal

We have multiple mechanism (Grievances Redressal Forum, Customer Relations Management (CRM), Vigilance Complaints, Vendor Grievance) to receive and resolve grievances of community, stakeholders, large public etc. Our grievances systems also ensure transparency, expectations of the community. GAIL has established a dedicated grievance cell in each of its offices and all complaints are received in a single system and each grievance is investigated separately and thoroughly with equal importance. GAIL has an Online Complaint System which has been introduced as a part of the 360° evaluation of receiving and redressing grievances of the community. Additionally, we also redress and resolve the complaints received on CPGRAMS.

Grievance Redressal Mechanism

At GAIL, two of our top priorities are stakeholder responses and concerns. The grievance redressal mechanism allows our stakeholders to submit complaints or grievances, which allows us to respond quickly to any issue raised by them, allowing us to provide better services. We have created an online grievance redress platform called ‘Samadhan’ that all our stakeholders can use to voice their complaints. Violations of systems and corruption, forgery, cheating, misappropriation, favours, deliberate ignorance, reckless decision-making, procedures and irregularities in the exercise of delegated power can all be reported and handled using our online portal: http:// GAILonline.com/onlineComplants. html. There is also an option to lodge complaints or problems directly with the factory head at every location of our operation through the OIC Sampark email.

To provide citizens and the public at large with a grievance redressal mechanism, all the written complaints received from all the workplaces and centres are uploaded to the Centralized Public Grievance Redressal and Monitoring System (CPGRAMS), which is accessible to all the citizens, who have lodged this complaint. CPGRAMS is a Government of India Portal, aimed at providing the citizens with a platform for redress of their grievances, where complaints are directly received by the MoPNG.

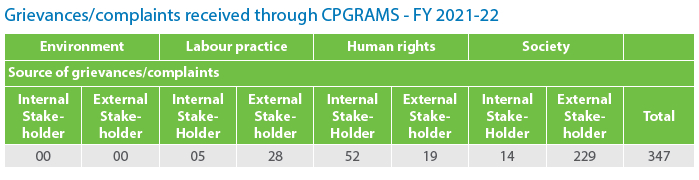

During FY 2021-22, a total of 347 public grievances through centralized public grievance redress and monitoring system (CPGRAMS) were received during the reporting period. All those received complaints on CPGRAM portal are resolved under the grievance redressal system.

Vigilance at GAIL

GAIL follows the guidelines and circulars of the Central Vigilance Commission for dealing with issues related to bribery or corruption in GAIL, its Subsidiaries as well as to the Joint Ventures (JVs), having jurisdiction of GAIL Vigilance Department.

As per the guidelines of Central Vigilance Commission, GAIL has adopted provision of lntegrity Pact in procurement in its tenders of value more than one crores for works, procurement of goods and services. Integrity Pact provides independent platform for monitoring compliance to established’ procedures, policies and guidelines of the CVC in tendering and resolution of complaints, if any. Presently, GAIL has a panel of three Independent External Monitors (lEMs), to monitor the implementation of lP in all tenders.

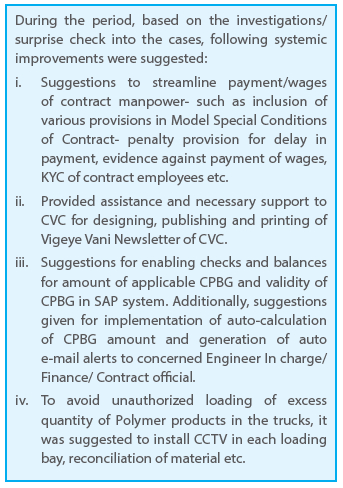

GAIL Vigilance reviews the internal processes, carries out regular surprise checks, periodic inspections, detailed intensive inspections and examination of CAG / Internal Audit paras for detection of Vigilance angles, if any. The lapses observed are analysed and systemic improvements are suggested to ensure avoidance of re-occurrence of lapses. Efforts are made to bring in continuous system improvement to ensure greater transparency, automation of processes for reducing manual intervention. To sensitize the stakeholders- employees, customers, contractors, vendors, various awareness workshops are held at various GAIL locations. During the FY-2021- 22, 38 surprise/ periodic inspections of various Contracts/ process/ files pertaining to various GAIL locations were carried out. In addition to this, 10 intensive inspection of contracts/ projects have been carried out by Vigilance Department.

We also celebrate Vigilance Awareness Week (VAW) every year under the guidance of Central Vigilance Commission (CVC), wherein all senior leadership and other employees actively participate in programmes and awareness sessions. In FY 2021-22, the Vigilance Awareness Week (VAW) was observed at our Corporate Office and at various site offices from 26th October to 01st November 2021 and the theme for this year was “Independent India @ 75: Self Reliance with Integrity; Lora= Hkkjr @ 75: lR;fu’Bk ls vkRefuHkZjrk”. On the occasion of VAW, Central Vigilance Commissioner, Sh. Suresh N. Patel addressed all GAIL employees from GAIL Corporate Offices. All major 40 GAIL locations were connected through video conferencing. GAIL was complemented for leveraging technology and robust systems and GAIL’s leadership was also lauded for its vision and digitalization of various business processes like Centralization of payments & taxes and Robotic Process Automation (RPA). On the occasion, CVC has also launched ‘Jagrook’, a special publication of GAIL Vigilance Department.

Highlights of VAW FY 2021-22 are:

- During VAW 2021, GM (Vigilance), Noida was felicitated by CVC for his contribution in preventive vigilance.

- GAIL CVO attended the Run-up programme for Vigilance Awareness Week-2021 organized during joint conference of CVC and CBI at Kevadia, Gujarat

- Business Partner Interactive Meet (Vendor Meet) in New Delhi and Customer Meet for Gas, Petrochemical and LHC customers of NCR, Jaipur and Lucknow zones were organized

- To sensitize the stakeholders- employees, customers, contractors, vendors, various awareness workshops are held at various GAIL locations. This year, GAIL supported the special drive of CVC to create awareness about Public Interest Disclosure and Protection of Informers (PIDPI) complaints and sensitized public on various provisions under PIDPI complaint mechanism by showcasing a short video film.

To sensitize the public at large, Gram Sabhas in 4 villages of Bangalore and Ranchi were organized. A review of policies and processes has also been conducted, with the goal of reducing corruption and ensuring overall good governance. Vendor meetings, customer interactive meetings, vigilance awareness workshops/sensitization programmes and engineer-in-charge coaching are held on a regular basis for all stakeholders to spread awareness on vigilance and handle issues effectively.

Vigilance department examines the complaints received from various sources. Based on the examination and investigation of complaints/ case, appropriate action against the concerned officials/ vendor/ supplier etc. is recommended to the Disciplinary Authority. Apart from this, regular surprise checks/ inspections are conducted to detect any system gaps/ lapses/ irregularities or any incidence of corruption.

FY 2021-22, we received 128 complaints under vigilance, 125 complaints (including previous year complaints) were successfully resolved.

Risk Management

- Risk Management is an ongoing process of identifying, analysing and managing risks within all the operational units of GAIL. While we adhere to all the standards and keep pace with our industry peers, we map and manage both financial and non-financial risks through Enterprise Risk Management (ERM).

- Risk assessment of several factors (climate change, fuel prices, energy supply security, etc.) that could potentially influence our business growth is studied and analysed through Enterprise Risk Management. As a part of the process, the risk management plan includes business continuity planning, risk communication and resource allocation, amongst others.

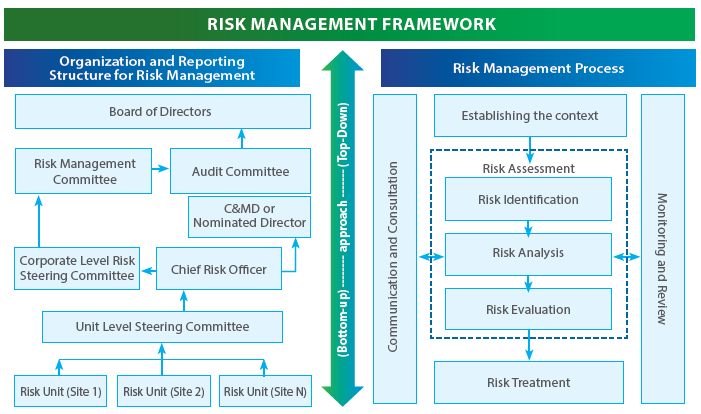

- Following framework describes risk management structure and risk management process at GAIL:

Overarching Management Approach

Our committed and independent Risk Management department implements the comprehensive risk management policy framework, on both the corporate and business levels to improve our approach to risk management to meet the demands of an evolving business environment. The risk management policy allows us to be proactive in reviewing, reporting and mitigating risks at our company while also contributing to longterm business growth.

The ERM provides an integrated framework for Board to examine organisational risks on a regular basis by offering an objective picture of the overall control system that leads to GAIL and its subsidiaries’ overall risk management. Furthermore, it provides a better grasp of the opportunities for improving company processes related to operations.

The ERM has been implemented in all facilities, including zonal marketing offices, across the company. The Board of Directors are the highest governing authority in charge of assessing the efficiency of GAIL’s risk management practices. The Board, through the Audit Committee, Risk Management Committee, Corporate Level Risk Steering Committee oversees the establishment and implementation of an adequate system of risk management across the organization. The Chief Risk Officer (CRO), unit level risk steering committee chairman and Corporate Level Risk Steering Committee review various types of risks whether existing and or anticipated in the short, medium and long-term in future. The Risk Management Department apprises the Corporate Level Risk Steering Committee (CLRSC) of executive directors chaired by the Director (BD) quarterly, Board level committee of RMC chaired by independent director biannually and Audit Committee and the Board annually.

Unit level risks including social and environmental risks are mapped and are being monitored quarterly through the unit level Risk Steering Committee headed by unit OICs/ Functional Heads. Mitigation measures are also devised and monitored by respective units. GAIL has identified top corporate key risks which includes market, logistic, strategic, JV subsidiary and financial risks.

Risk Management and Strategic Initiatives

GAIL’s comprehensive risk management initiatives enable us to meet our goals and protect our operations while adhering to legal, regulatory and societal expectations. We improve our ability to respond and adapt to the changing environment by mitigating risks.

Our risk management entails a three-step examination that includes identifying, analysing and evaluating potential threats to corporate operations. This procedure aids in the strategic direction and management of our company’s operations, as well as the proper risk management. A risk register review report is submitted by the unit risk owners quarterly by the 10th day, following the quarter-end and a risk database review report is submitted annually by 15th June, following the financial year-end through online Risk Management System (RMS).

The Company evaluates various types of risks, including commercial and financial risks as well as non-financial risks such as climate change, fuel pricing and energy supply security, all of which could have an impact on the Company in the future. The “Risk Rating” is assigned to the identified risks based on their impact on the organisation and the chance of occurrence. The duration between the occurrence of an incident and its impact on GAIL is considered while calculating “Risk Velocity.”

The corporate level risk steering committee (CLRSC) is expected to examine the status of all Corporate Level Residual Key Risks, including economic, environmental and social risks, on a quarterly basis, as per the authorised Risk Management policy. Prior to placing before Audit Committee, the status is deliberated in the Risk Management Committee (RMC). The status is put up to the Board annually for approval. We are very sensitive to the environmental impact of our operations. Efforts are always in place to minimize / neutralize the impact of greenhouse gases and zero waste disposal. Various units are working to identify the threat posed by climate change. Within GAIL HSE, there are groups that coordinate all risks related to environmental and safety issues. The CSR group oversees coordinating all risks associated with social and CSR issues. These groups ensure that all present and future environmental, economic and social risks are identified, qualitatively and quantitatively assessed, analysed and correctly managed through the implementation of effective mitigation plans. Our Management is updated on a regular basis by both groups.

The detailed risk can be referred from Management, Discussion and Analysis section of GAIL Annual Report FY 2021-22 through our official website.

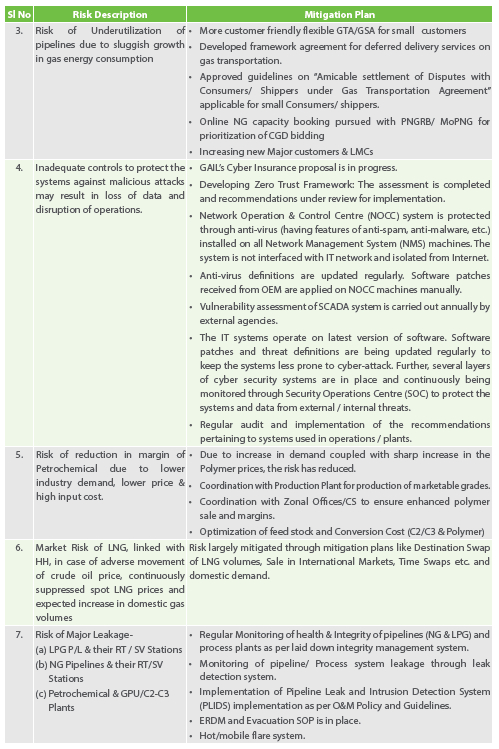

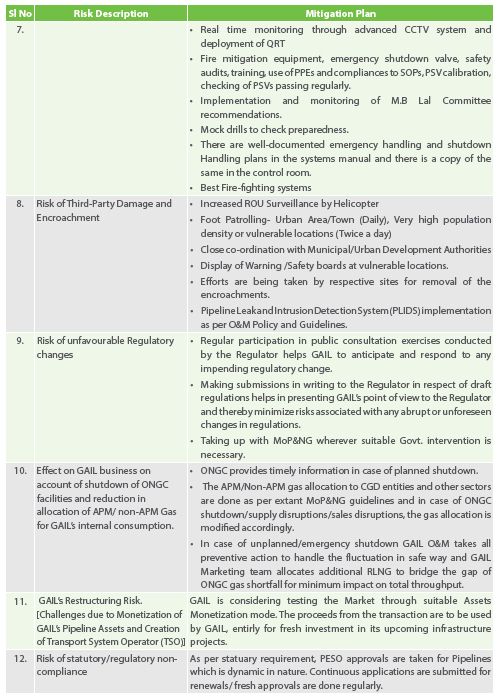

Key Risks and Mitigation Measures

Some risks are simpler to control, while others necessitate a significant amount of time. As a result, tying risks to the financial year is challenging. To improve operational performance, the GAIL Corporate Level Risk Steering Committee has identified risks and mitigation strategies. We are taking the necessary steps to resolve/deliberate the risks that have been identified. Stakeholders should consult the Management Discussion and Analysis (MD&A) section of the Annual Report for more information on specific risks.

Advocacy through Coalitions and Associations

Through trade and industry organisations, we are always involved in public policy debates and legislative developments. GAIL was a part of 19 national and international institutions in FY 2021- 22, which are listed below:

- International Group of Liquefied Natural Gas Importers (GIIGNL)

- Federation of Indian Petroleum Industry (FIPI)

- Standing Conference of Public Enterprises (SCOPE)

- Federation of Indian Chambers of Commerce & Industry (FICCI)

- Global Reporting Initiative (GRI)

- Chemicals & Petrochemicals Manufacturers’ Association (CPMA)

- TERI- Business Council for Sustainable Development (TERIBCSD)

- Indian Wind Power Association (IWPA)

- Natural Gas Society (NGS)

- Biogas Indiantech Association

- British Safety Council

- National Fire Protection Association (NFPA)

- Transparency International India (TII)

- Delhi Productivity Council (DPC)

- US India Strategic Partnership Forum

- India Myanmar Chamber of Commerce (IMCC)

- International Market Assessment CFO Forum

- Institute of Directors (IOD)

We are a member of several respected industry organisations and associations, which provide a forum for discussing industry issues and bringing industry voices to the attention of the government to develop more inclusive policies and reforms.

This provides a solid foundation for the growth of the public good. We made a member fee of INR 1.4 crore to various trade associations and think tank groups during this reporting year to build a positive and nurturing environment for businesses and stakeholders. We also communicate with PNGRB, the regulatory agency, on a regular basis to keep them up to date on current events and industry perspectives.

We are one of India’s three members of the International Group of Liquefied Natural Gas Importers (GIIGNL). GIIGNL provides GAIL with a venue for industry counterparts to share information and expertise to improve the safety, reliability and efficiency of LNG imports and LNG import terminal operations.

We are a member of the Governing Council of the Federation of Indian Petroleum Industries (FIPI). FIPI has several executive committees dedicated to GAIL’s interests, all of which have GAIL member representation. FIPI serves as the oil industry’s interface with the Indian government, regulatory agencies, the public at large and trade associations to work on topics such as resource optimization, safety, tariffs, investments, a healthy environment and energy conservation, among other issues.

We are an active member of Standing Conference of Public Enterprises (SCOPE), which is the apex body, representing the entire spectrum of public sector enterprises (PSEs) in India. SCOPE has representations in various high-level Committees/Boards and helps its member PSUs to reach their voice to various platforms.

We are the member of Federation of Indian Chambers of Commerce & Industry (FICCI) Executive Committee and Co-Chair of FICCI Hydrocarbon Committee. The Hydrocarbon Committee aims to deliberate on matters linked to the country’s energy security and, via its intellectual input, augment the Government of India’s and other bodies’ work in this field. GAIL’s Chief Executive Officer is also a member of the Oil Industry Development Board (OIDB).

The Global Reporting Initiative (GRI) is an independent, multinational organisation that assists companies and other organisations in taking responsibility for their impacts by establishing a global standard language through which they may communicate such impacts. Since 2013, we have been a founding member of the GRI South Asia Consortium. We have made a significant contribution to GRI’s purpose and the continued development of the GRI Standards as a member. GRI consolidate best practice into the global common language for sustainability reporting, enabling companies, investors, policy makers and other stakeholders to manage and evaluate corporate activities in support of sustainable development.

We are a member of the Chemicals & Petrochemicals Manufacturers’ Association (CPMA), which is the industry’s apex forum. The Association, which was founded in 1993, provides a forum for members to share their thoughts, express their concerns and make recommendations on pertinent subjects. It serves as a link between the private sector, the government and society. To promote and sustain harmonious and conducive business environment, it works with policymakers and industry associations.

We are a member of the TERI-Council for Business Sustainability (TERI-CBS), an industryled consortium of sustainability experts. GAIL and TERI have collaborated on a document that explains the Indian corporate vision on many areas of addressing climate change, as well as aligning the vision with government initiatives in this area.

We have undertaken various studies on areas of gas advocacy such as unbundling in the natural gas sector in India and its impact, the study of gas markets hubs and strategic imperatives for GAIL. Additionally, study on opportunity mapping for GAIL in the battery value chain, demand assessment in the refinery sector, steel sector, potential of natural gas as a replacement for solid and liquid polluting fuels consumption in industries under any CGD gas and price-sensitive demand assessment, enabling factors for natural gas in steel sector have been done to under and assess the dynamic natural gas markets of the country. Further, analysis on competitiveness of natural gas with a view of GST inclusion for industries. We have assisted in the development of the oil and gas sector and the formulation of policy for the development of the CGD sector in India.